Don’t be a victim of cyber scams and phone fraud. These tips from the FTC will help you to avoid some of the most common cyber and phone fraud schemes. (updated June 2024)

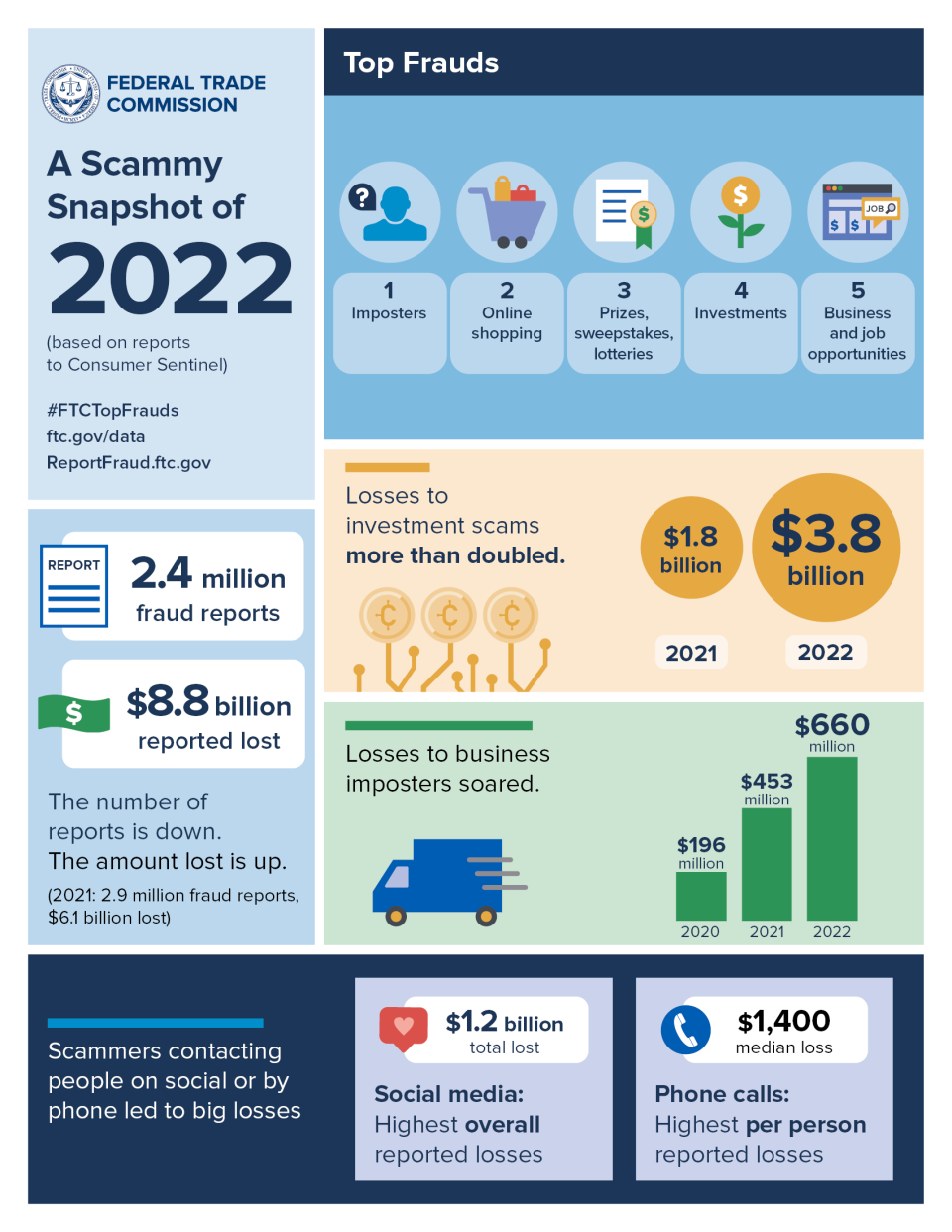

One of the problems that we hear a lot about from calls to our member helpline is online fraud, and it’s no wonder. Last year, the Federal Trade Commission (FTC) reported that Americans lost $8.8 billion to scams. That’s just what was reported – the total was no doubt higher because many people feel too embarrassed to report that they fell for a scam. Two types of scams accounted for nearly three-quarters of the money lost: Investment scams and impersonator scams. Below, we’ve included an FTC infographic about the top 5 scams in 2022. .

14 Tips to Protect Yourself from Cyber and Phone Fraud

Even if you’re cyber savvy, you aren’t immune to falling for a scam. Fraudsters put a great deal of time, effort and technology into trying to trick you. The FTC is the government agency charged with preventing fraudulent, deceptive, and unfair business practices. They also provide information to help consumers spot, stop, and avoid scams and fraud.The following tips for avoiding scams were taken directly from advice issued by the FTC that we’ve gleaned from recent press releases an alerts.

- Don’t click on links or respond to unexpected texts. If you think a text might be legit, contact the company using a phone number or website you know is real. Don’t use the information in the text message.

- Don’t respond to unsolicited offers. If you get an out-of-the-blue call, text, or e-mail that seems to come from an online retailer, your bank, credit card, or a payment app, they’re likely phishing scams. Don’t click links. Don’t respond. Hit block and delete.

- Never pay someone who promises a job. No honest employer will ever make you pay for a job. They also won’t send you a check and then tell you to buy supplies, pay for training, or something else — and send back whatever money is left. Those are scams.

- Don’t believe promises of guaranteed returns or income. There’s no such thing as an investment with little to no risk: not in cryptocurrency or any other investment. But if someone tells you that, you know they’re a scammer.

- Don’t respond to urgent deadlines. Most unexpected emails saying to act quickly, click a link, or call a number are phishing scams. They may look like they come from companies you know, but they’re from scammers who want you to think the message is real.

- Don’t click on any links. Links in unexpected texts or emails could lead to identity theft or let scammers install malware.

- Don’t pay for help managing your student loans. If you have federal student loans, start at StudentAid.gov/repay. If your loans are private, go directly to your loan service. It’s their job to help you — for free.

- Don’t respond to threats. Honest businesses won’t say you’ll be arrested, deported, or lose your license unless you pay. Neither will the government. If someone does, you know it’s a scammer.

- Never pay anyone who insists you pay with cryptocurrency, a wire transfer or a gift card. That’s how scammers want you to pay.

- Don’t pay for anything with a gift card. Gift cards are for gifts, not for payments. If anyone asks you to pay with a gift card, it’s a scam.

- Don’t give your personal or financial information to anyone who contacts you out of the blue. Government agencies won’t call, email, text, or message you on social media to ask for personal information, like your Social Security or bank account numbers.

- Don’t trust your caller ID. Caller ID can be faked. It could be anyone calling from anywhere in the world.

- Don’t answer or return any calls from numbers you don’t recognize.

- Check before calling. Before calling unfamiliar numbers, check to see if the area code is international.

More resources on common online and phone scams

- Cybersecurity & Infrastructure Security Agency

- FBI: Common Scams & Crimes

- FTC: Phone Scams

- What To Do if You Were Scammed

- If you spot a scam, report it at ReportFraud.ftc.gov